Downtown vs. Power Center: Where to Place Your Bet on Kyle's Future Retail Landscape

Downtown vs. Power Center: Where to Place Your Bet on Kyle's Future Retail Landscape

The Kyle market is booming, driven by its strategic location between Austin and San Antonio and massive residential growth. This demographic explosion has created unprecedented demand for retail space, leading to two distinct and competing investment opportunities for commercial real estate:

- The Power Center: Large, freeway-adjacent developments built for convenience, featuring national chains and high visibility.

- The Downtown Core: The historic heart of Kyle, targeted for a character-driven revitalization focused on specialized, experience-based commerce.

Understanding which segment offers the better long-term return requires more than just analyzing traffic counts; it demands a deep dive into the city's strategic vision for its future retail identity.

The Power Center Thesis: Convenience and Immediate Cash Flow

The new retail centers sprouting along I-35 and major arterials like FM 1626 are built on a simple, proven model: density meets accessibility. These Power Centers serve the immediate needs of the thousands of new residents flocking to Homes for sale in Kyle and its neighbors like Homes for sale in Buda. The tenants—large grocery anchors, national big-box stores, and fast-casual dining—benefit from freeway visibility and massive parking fields.

Investment Profile:

- High Demand: Low vacancy rates due to rapid population growth.

- Strong Tenants: National credit tenants provide stable, predictable income streams.

- Risk: Potential for oversupply if development outpaces population, and long-term risk of e-commerce disruption to commodity retail.

The Downtown Core Thesis: Specialization and Long-Term Appreciation

The Downtown revitalization plan, backed by over $19 million in cumulative city investment, aims for the opposite effect. It recognizes the historic core's limitations—tighter spaces, older infrastructure, and the complexity of the rail line—and instead leans into its strengths: authenticity, local culture, and experience.

The city actively targets "specialized retail"—boutique shops, destination restaurants, local breweries, and cultural venues. This strategy seeks tenants whose value proposition is the atmosphere and unique experience, not just convenience. The recent, strategic land acquisitions by the city are designed to reduce risk for private investors and clear the path for better mixed-use zoning.

Investment Profile:

- Character Premium: Property values appreciate based on the unique, irreplaceable historic aesthetic.

- Defensive Against E-commerce: Experience-based retail (dining, arts) is inherently protected from online competition.

- Risk: Slower realization of returns, reliance on continued municipal commitment, and the initial infrastructure hurdles (parking, traffic).

The Retail Value Matrix: Which Bet is Right for You?

Placing your bet on Kyle’s retail future depends entirely on your investment horizon, risk tolerance, and management style:

| Factor | Power Center Investment | Downtown Core Investment |

|---|---|---|

| Primary Value Driver | Traffic Counts & Convenience | Character & Specialized Experience |

| Typical Tenant | National Chains & Big Box | Local Boutiques & Destination Dining |

| Time to Stabilization | 1-3 Years (Quick) | 5-10 Years (Phased) |

| Exit Strategy | Sale to Institutional Investors | Sale to Lifestyle/Niche Portfolio Buyers |

| Management Focus | Lease Administration & Maintenance | Tenant Curation & Relationship Building |

A Look at the Domino Effect

Consider the broader context of Central Texas growth. Successful downtown revitalizations in nearby towns like Buda have shown that character-driven retail can achieve significantly higher rents and lower long-term vacancy than initially projected. As new apartment and mixed-use projects are permitted into the Kyle core, they create a dense, walkable customer base, insulating downtown retail from the suburban drive-by model.

While the Power Center offers the security of national leases and the promise of immediate returns, the downtown investment is a bet on the creation of irreplaceable commercial architecture and civic identity. It's a classic real estate principle: they can always build another strip mall, but they can't recreate authentic history.

Next Steps for Retail Investors

Whether your goal is stabilized, immediate income in a Power Center or long-term, high-appreciation boutique ownership in the core, the Kyle market offers dynamic options. If you are ready to explore the specific land and commercial opportunities in either segment, let's discuss your investment thesis.

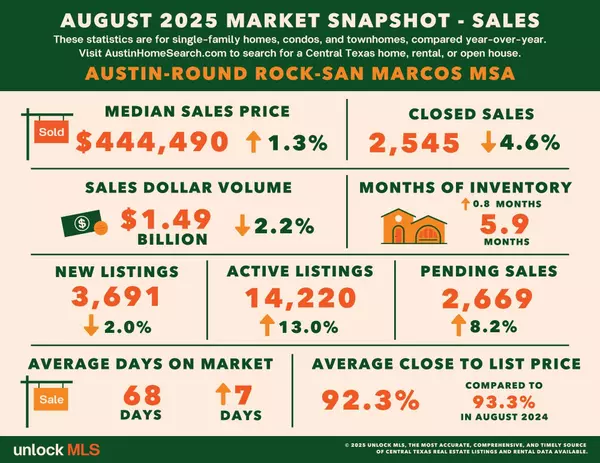

- To compare retail values across the region, Check the Market Snapshot.

- For recent transaction data on retail centers and downtown properties: See Recently Sold Nearby.

- Ready to jump into the market? Browse All Homes for Sale and commercial listings.

Categories

Recent Posts